What is a Business Grant?

A business grant is a contribution, gift, or subsidy often provided by the government, or other organisations, for specific purposes.

In almost all cases, to obtain a business grant, you will have to make a formal application. The application will outline: the project that you propose to undertake; the expected costs and benefits of conducting the project; and give a history of the business applying for the grant.

A variety of UK grants are available to support a range of business activities, including for charitable and research purposes.

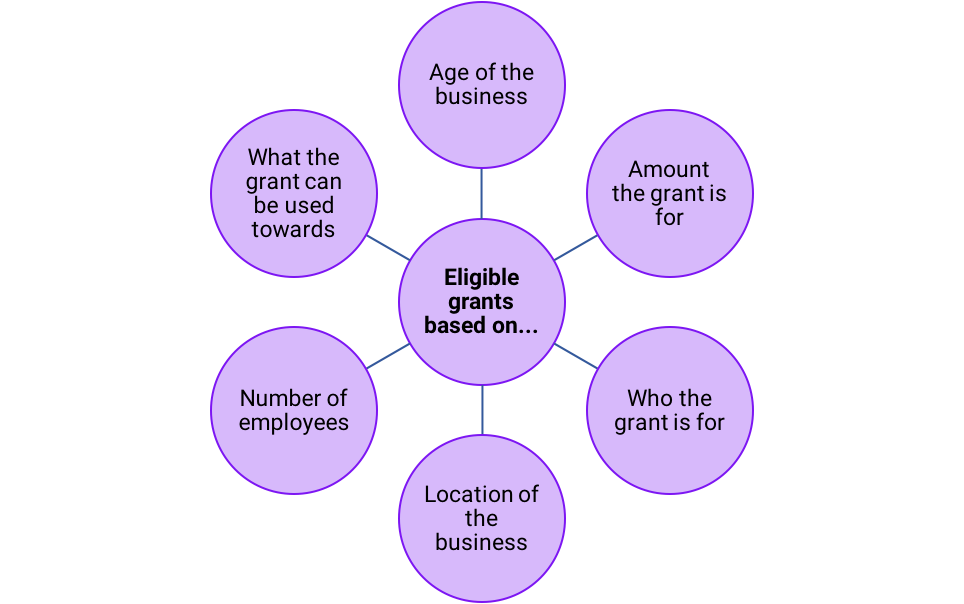

The Grant Provider will set the eligibility for business to qualify for grant funding. The exact rules will vary from one grant fund to the next, but most will be based around:

Grant funding tends to be more readily available in some fields of business than others, including:

- Energy and environment: creating products that are environmentally friendly.

- Exports: investing in trade links to drive the economy forward.

- Innovation: increasing the evolving global tech market from the UK.

Categories of Grants

Business grants are catagorised by reference to the age of the applicant, its sector and location. Common catagorisations include small business grants, start up business grants and pre-trading grants, see page links below for more information.

Start-Up Grants

Start-ups, or newly emerging small businesses, tend to be fast-growing. They aim to meet a marketplace need by developing an innovative produ…

Entrepreneur Grants

According to HMRC, a business has not yet become active or started trading if it has not yet engaged in any business activity. Even for early-stage…

Established Businesses

An established business is one that has obtained a reputation for a specific product, service, process, or platform. Most established companies wil…

How business grants influence the accounts?

Grant funding to cover expenditure recorded in the business’ profit and loss account, should be marked as income in those accounts.

Grant income relating to future expenditure will be deferred in the accounts over a number of years. Deferral in this way enables you to enter the grant on the business’ balance sheet, and then at a later date, release to the profit and loss account when the actual expenditure takes place.

A grant to purchase capital equipment, machinery and other fixed asset is deferred and released to the profit and loss account. This release will match depreciation of the asset.

For corporation tax purposes grants are usually taxable income.