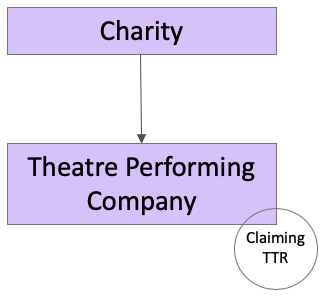

In the theatre production world when charities are involved, it is common occurrence where a charity sets up a separate trading subsidiary which becomes the theatre production company. The subsidiary company is subject to UK corporation tax and the standard TTR requirements for commercial entity then apply.

This model of using a wholly owned trading subsidiary vehicle is also commonly seen in the other creative industries in UK.

Care must be taken that the trading subsidiary (i.e. not the charity) actually performs the theatre performing company functions (negotiating contracts, producing, running and closing the production etc.). Merely using a subsidiary company to claim the tax relief, while the charity performs the theatre performing company functions is not allowed.

Care must be taken that the trading subsidiary (i.e. not the charity) actually performs the theatre performing company functions (negotiating contracts, producing, running and closing the production etc.). Merely using a subsidiary company to claim the tax relief, while the charity performs the theatre performing company functions is not allowed.

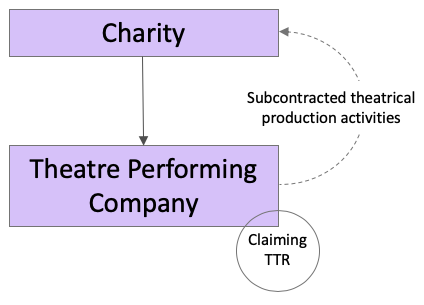

However, the trading subsidiary which meets the TTR requirements can subcontract some of the theatrical production activities back to a not-for-profit organisation.

A charity should seek professional advice to see if using this operating model will not impact on its charitable status and should also consider the implications on VAT liability.

There are also possible VAT implications for Charities involved in Theatre Productions, depending on the charity and theatre performing company structuring and activities.

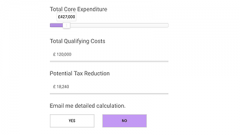

Check Theatre Tax Relief Eligibility

Use the TTR eligiblity test tool to quickly assess if your theatre production company and production qualifies.