HMRCs R&D Statistics 2017 have been recently updated[1] and the new figures show a breakdown of the R&D claims by sectors, regions, volume and value of all the claims.

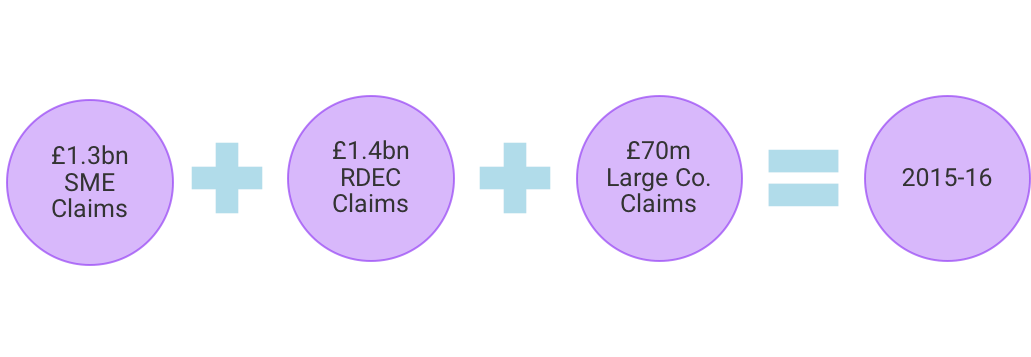

A staggering £2.9bn of R&D tax relief was claimed in 2015-16, an increase of 20% from the previous year. Since the launch of R&D tax credit schemes, back in 2000, over 170,000 claims have been submitted and £16.5bn in tax relief has been claimed.

HMRC’s R&D Tax Credits Statistics continue to show how R&D tax credits are supporting innovation in the UK, revealing how R&D tax relief scheme encourages greater R&D spending, leading to a greater investment in innovation.

The statistics have portrayed yet again, a clear overall increase in the number of claims submitted and the total sum of relief claimed.

The growth

The growth

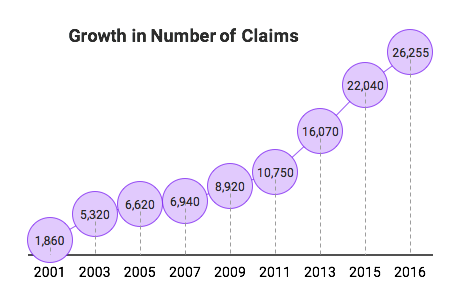

In 2015-16, the total number of R&D claims rose by 19% to a high of 26,255. This rise was largely driven by the increase of SME claims, accounting for 83%.

The total number of SME claims rose by 22% to 21,865, while the total number of Large/RDEC claims also increased by 5%.

This growth supports the idea that companies are becoming increasingly aware of the tax relief schemes and repeatedly investing in more R&D.

There are more claims submitted via the SME scheme, a greater proportion of the amount claimed is by Large companies.

R&D expenditure against which claims were made has been on a rising trend. The total value of R&D expenditure was £22.9bn, an increase of 4%.

Who are the main R&D claimants?

Who are the main R&D claimants?

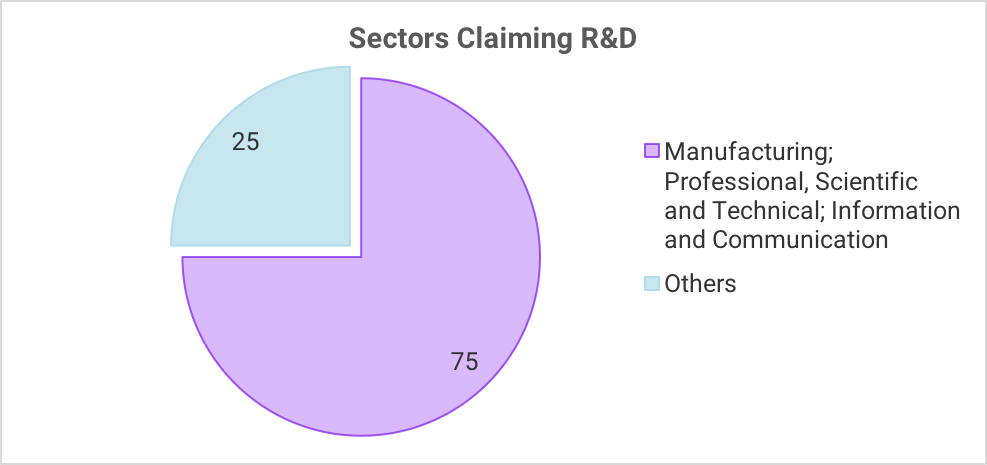

Manufacturing, Professional, Scientific and Technical and Information and Communication sectors took the lions share of claims, accounting for 75% of the total amount claimed.

Unsurprisingly, R&D claims were highly concentrated in companies with a registered office in London, the South East and the East of England, in terms of both volume and value. 62% of the total amount claimed came from these 3 regions collectively.

What about first time R&D applicants?

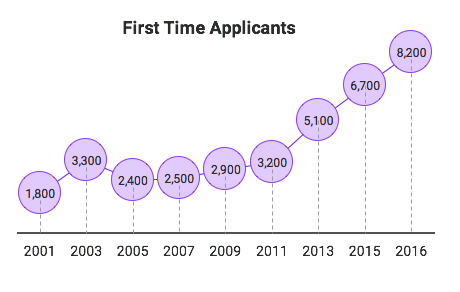

The removal of the minimum claim requirement of £10,000 in 2012-13, has given more SME’s the opportunity to claim.

Significantly more SME’s carrying out lower level R&D spending (<10,000), are eligible to claim for which they weren’t previously.

RDEC claims continue to grow since being introduced in 2013. Previously, Large loss making companies couldn’t claim an immediate cash benefit. For a loss-making Large company in particular this was unbeneficial and only resulted in a further loss.

The RDEC scheme has proven to be a success. Its has provided a way for profitable and loss making companies to equally receive a cash benefit. The scheme has also resulted in an increase of first time applicants, attracting more innovative Large companies.

The number of first time applicants peaked significantly in 2012 and has continuously been rising. The removal of the minimum claim requirement had an obvious effect on the number of first time applicants claiming R&D tax relief.

HMRC R&D statistics show that the largest number of claims came from companies that are between 5-10 years old. 22% of the total volume of claims came these companies. New companies were also at a high of 17%.

The positive trends clearly portray how SME’s and Large companies have been spending more, claiming more and receiving more back for R&D.

The positive trends clearly portray how SME’s and Large companies have been spending more, claiming more and receiving more back for R&D.

To explore if your company can benefit contact our team. A brief chat could save the company thousands in cash.