Charities are usually exempt from corporation tax on revenue sources such as: trading profits, rental income, capital gains and interest, provided these are for charitable purposes only. So how can tax relief be claimed if there is no corporation tax to pay?

The answer is simple. The same Theatre Tax Credit calculation applies to a qualifying not-for-profit theatre producing organisation as it apples to a commercial theatre company. This means that qualifying charities and community interest companies are entitled to claim theatre tax credit on their enhanced qualifying expenditure.

There is one final requirement that must be met which is that, for tax purposes, each individual production must be treated as a separate theatrical trade.

It is recommended that a charity should seek professional advice to see if being recognised as a theatrical production company for the purpose of claiming theatre tax relief may impact its charitable status.

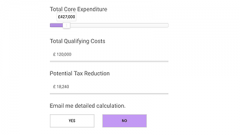

Calcualte Theatre Tax Credits

Online TTR calculator can estimate how much your theatre company can claim.