Across a broad array of industry sectors, R&D tax credits – or even a reduction in Corporation Tax – are waiting to be claimed.

At R&D Tax Solutions, we have the necessary experience to help large and small UK businesses alike determine their eligibility for such tax relief.

Some of the industries we support include:

Architecture

The research and development of architectural technology and techniques can qualify for government tax relief. Architecture spans the mathematical …

Aviation

Aviation is known for the high complexity of its components, often subject to lengthy Research & Development programs which often qualify for R…

Engineering

Engineering by its very nature is the development of existing components, communication methods and the integration of new and old technology. To q..

Food & Drink

Food and Drink R&D Tax Relief The development of food and drink has been around since time began; this doesn’t mean that new advances are not …

Land Remediation

Can R&D Tax Credits be added to Land Remediation Relief? Land remediation tax relief is well known in the UK, but why only few companies reali…

Manufacturing

R&D Tax Credits have been the highlight in a number of recent discussions in the manufacuting sector. The possibility to significantly boost p…

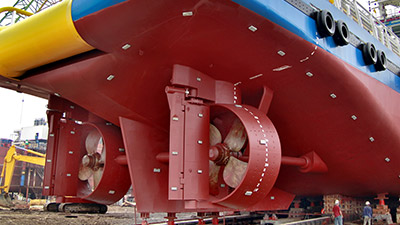

Marine

Could your Marine Company Qualify for R&D Tax Credits? It has been stated the UK is the fourth largest ship builder and the third larges boat …

Medical

The Medical industry is split into many sub divisions. All aspects of medical development in one way or another stem from scientific research and …

Software

Software Development R&D Tax Credits, Ways to Boost your Code. It is no surprise that the software and IT industry are fast evolving and conti…

Agriculture

Many farmers and companies filtering into the agriculture sector engage in activities which could potentially qualify for research and development …

Internet Of Things

The Internet of Things (IoT) is altering the world in which we live in today. From changing how we drive, to how we make payments. IoT have impro…

Pharma

The pharmaceutical industry spans a range of sub sectors, all of which may benefit from Pharmaceutical R&D Tax Credit. These include …