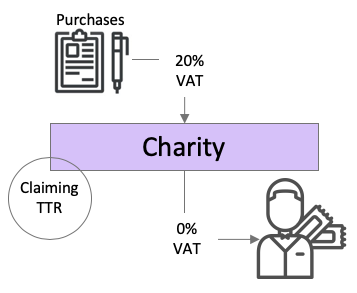

Non-for-profit organisations often pay VAT for services and goods they receive. At the same time, their charges for live performances admissions (e.g. ticket sales) are often exempt from VAT.

The VAT exemption on ticket sales is frequently an important benefit which allows the non-for-profit organisation to maintain competitive ticket prices available to the general public.

This VAT exemption is often granted on the basis of ‘eligible body’ – i.e. the non-for-profit organisation needs to meet a strict criterion:

- Profits are not distributed,

- Profits are applied to benefit its cultural activities, and

- Management is performed essentially on a voluntary basis by persons with no financial interests in the organisation.

Involvement via a wholly owned trading subsidiary

Another commonly seen example is when the theatrical performance company as a wholly owned trading subsidiary of a not-for-profit organisation. This set-up can also similarly lead to the theatre production company paying VAT on purchases, but the sales of tickets for admission being exempt for VAT.

Theatre tax relief for charities is a complex area. Charities should seek a professional advice to ensure it’s VAT exemption status, charity status and eligibility for theatre tax relief are not impacted by the various activities undertaken.

The VAT law and applicable exemptions are quite a complex area for the purpose of this overview. The VAT guidance at Public Notice 701/1 Charities for how charities may be subject to VAT.